|

Presented by

The Huscher Team |

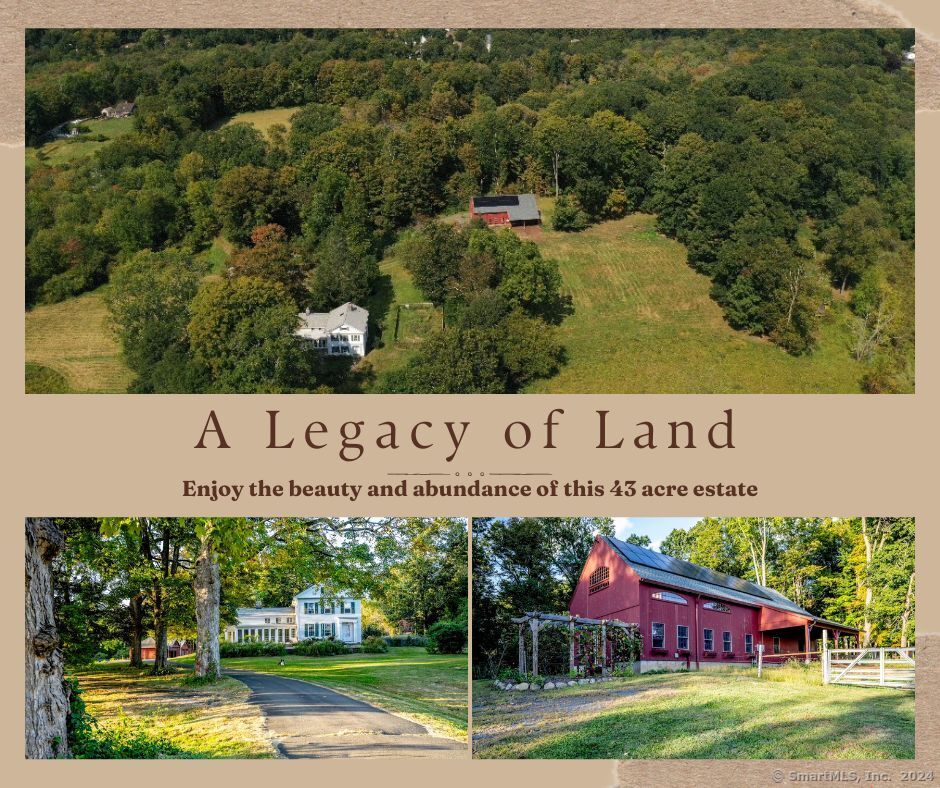

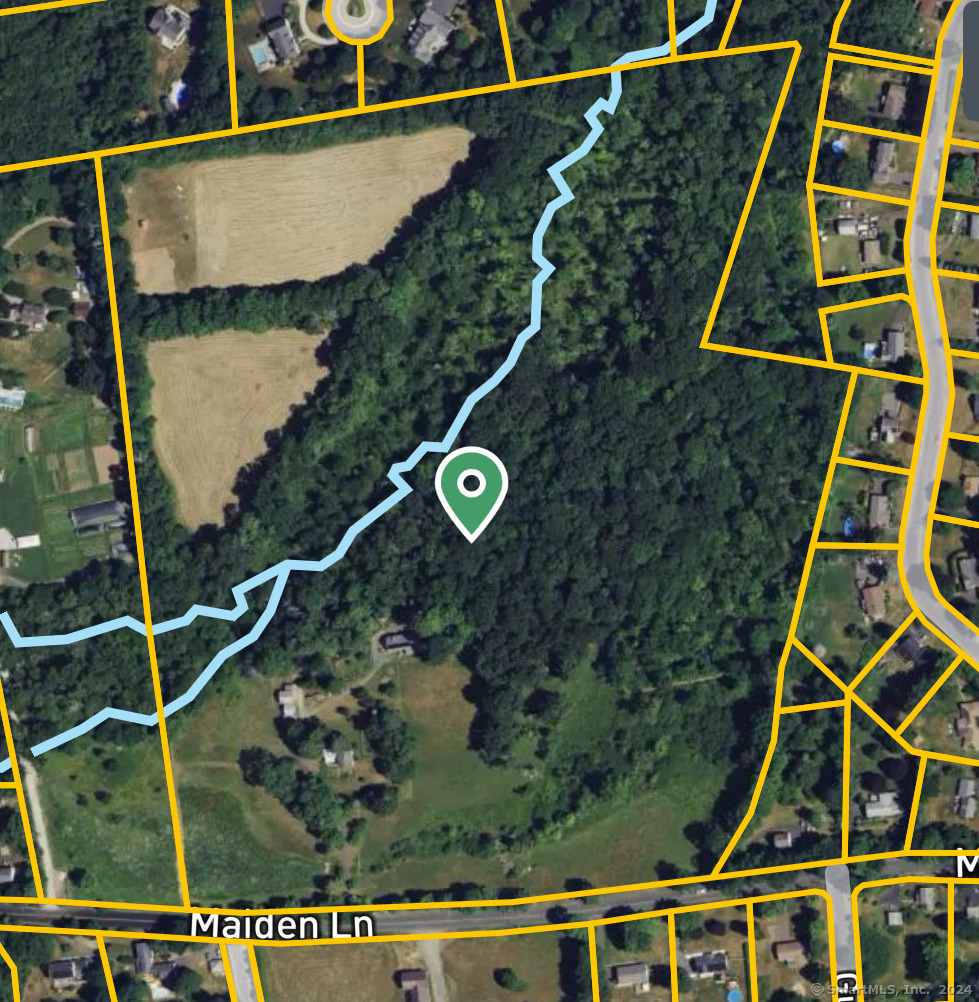

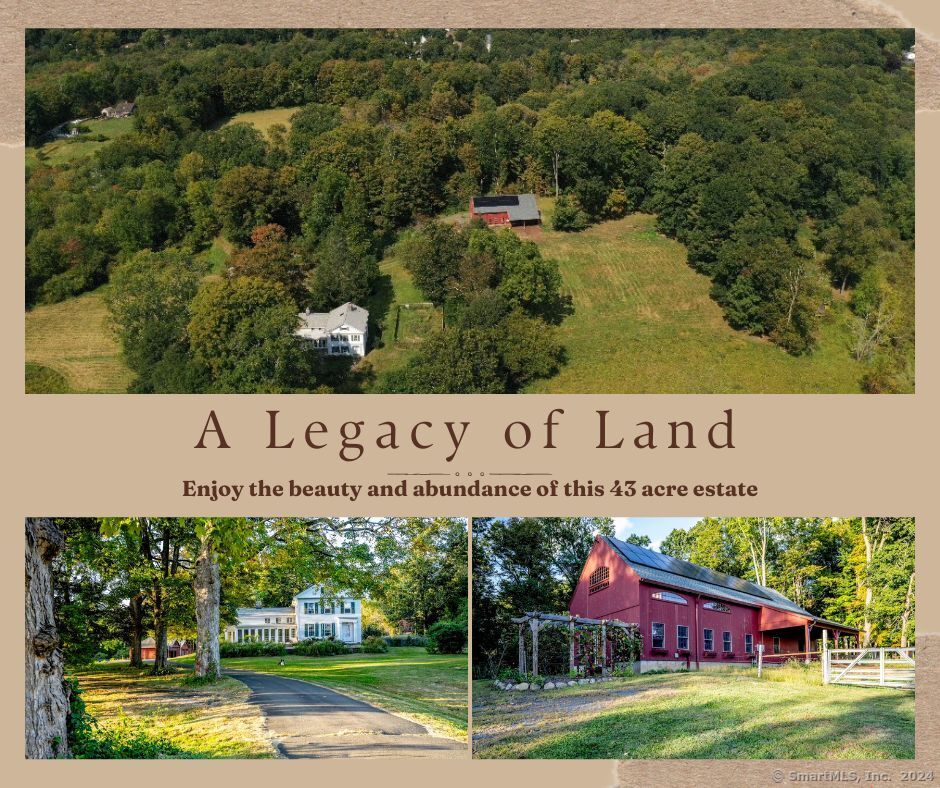

142R Maiden Lane, Durham, CT, 06422 | $899,000

Nestled amidst the picturesque landscape, this historic 43-acre homestead, once owned by the renowned Yale professor and author James C Scott, offers a unique opportunity to create your own rural haven. The property features a charming antique colonial farmhouse built in 1826. While the house requires some personal updating, its timeless character and potential are undeniable. Imagine transforming this historic gem into your dream home. The exposed beams, hardwood floors, and character-filled spaces provide a blank canvas for your creative vision. A modern barn, constructed in 2020 with radiant heat, offers ample space for your agricultural pursuits or creative endeavors. Whether you dream of raising livestock, cultivating organic crops, or simply enjoying the peace and quiet of rural living, the barn with studio offers endless possibilities. Beyond the farmhouse and barn, the property's natural beauty unfolds. Explore the meandering trails through lush meadows, serene woodlands, and peaceful wetlands, where Highland Cattle once grazed. Picture the tranquility of the scene, with these majestic animals roaming the land. A conservation easement protects the property's natural features, ensuring that its beauty and agricultural potential will be preserved for generations to come. The property is equipped with solar panels, providing a clean and renewable energy source. Don't miss this extraordinary opportunity to own a piece of agrarian history and create a sustainable future!

Features

- Rooms: 9

- Bedrooms: 4

- Baths: 2 full

- Style: Colonial

- Year Built: 1826

- Heating: Steam

- Cooling: None

- Basement: Full

- Above Grade Approx. Sq. Feet: 2,427

- Acreage: 43.23

- Est. Taxes: $8,914

- Lot Desc: Lightly Wooded,Farm Land,Level Lot

- Elem. School: Brewster

- High School: Coginchaug Regional

- Appliances: Oven/Range,Refrigerator

- MLS#: 24048807

- Days on Market: 55 days

- Buyer Broker Compensation: 0.00%

- Website: https://www.raveis.com

/raveis/24048807/142rmaidenlane_durham_ct?source=qrflyer

Room Information

| Type | Description | Level |

|---|---|---|

| Bedroom 1 | Upper | |

| Bedroom 2 | Upper | |

| Bedroom 3 | Upper | |

| Dining Room | Main | |

| Family Room | Upper | |

| Living Room | Wide Board Floor | Main |

| Primary Bedroom | Upper |

William Raveis Family of Services

Our family of companies partner in delivering quality services in a one-stop-shopping environment. Together, we integrate the most comprehensive real estate, mortgage and insurance services available to fulfill your specific real estate needs.

The Huscher TeamSales Associates

860.918.4580

TheHuscherTeam@raveis.com

Our family of companies offer our clients a new level of full-service real estate. We shall:

- Market your home to realize a quick sale at the best possible price

- Place up to 20+ photos of your home on our website, raveis.com, which receives over 1 billion hits per year

- Provide frequent communication and tracking reports showing the Internet views your home received on raveis.com

- Showcase your home on raveis.com with a larger and more prominent format

- Give you the full resources and strength of William Raveis Real Estate, Mortgage & Insurance and our cutting-edge technology

To learn more about our credentials, visit raveis.com today.

Dave BeckmanVP, Mortgage Banker, William Raveis Mortgage, LLC

NMLS Mortgage Loan Originator ID 10930

203.641.8287

Dave.Beckman@raveis.com

Our Executive Mortgage Banker:

- Is available to meet with you in our office, your home or office, evenings or weekends

- Offers you pre-approval in minutes!

- Provides a guaranteed closing date that meets your needs

- Has access to hundreds of loan programs, all at competitive rates

- Is in constant contact with a full processing, underwriting, and closing staff to ensure an efficient transaction

Brian KellyInsurance Sales Director, William Raveis Insurance

860.655.6934

Brian.Kelly@raveis.com

Our Insurance Division:

- Will Provide a home insurance quote within 24 hours

- Offers full-service coverage such as Homeowner's, Auto, Life, Renter's, Flood and Valuable Items

- Partners with major insurance companies including Chubb, Kemper Unitrin, The Hartford, Progressive,

Encompass, Travelers, Fireman's Fund, Middleoak Mutual, One Beacon and American Reliable

Ray CashenPresident, William Raveis Attorney Network

203.925.4590

For homebuyers and sellers, our Attorney Network:

- Consult on purchase/sale and financing issues, reviews and prepares the sale agreement, fulfills lender

requirements, sets up escrows and title insurance, coordinates closing documents - Offers one-stop shopping; to satisfy closing, title, and insurance needs in a single consolidated experience

- Offers access to experienced closing attorneys at competitive rates

- Streamlines the process as a direct result of the established synergies among the William Raveis Family of Companies

142R Maiden Lane, Durham, CT, 06422

$899,000

The Huscher Team

Sales Associates

William Raveis Real Estate

Phone: 860.918.4580

TheHuscherTeam@raveis.com

Dave Beckman

VP, Mortgage Banker

William Raveis Mortgage, LLC

Phone: 203.641.8287

Dave.Beckman@raveis.com

NMLS Mortgage Loan Originator ID 10930

|

5/6 (30 Yr) Adjustable Rate Jumbo* |

30 Year Fixed-Rate Jumbo |

15 Year Fixed-Rate Jumbo |

|

|---|---|---|---|

| Loan Amount | $719,200 | $719,200 | $719,200 |

| Term | 360 months | 360 months | 180 months |

| Initial Interest Rate** | 5.500% | 6.375% | 5.875% |

| Interest Rate based on Index + Margin | 8.125% | ||

| Annual Percentage Rate | 6.821% | 6.474% | 6.036% |

| Monthly Tax Payment | $743 | $743 | $743 |

| H/O Insurance Payment | $92 | $92 | $92 |

| Initial Principal & Interest Pmt | $4,084 | $4,487 | $6,021 |

| Total Monthly Payment | $4,919 | $5,322 | $6,856 |

* The Initial Interest Rate and Initial Principal & Interest Payment are fixed for the first and adjust every six months thereafter for the remainder of the loan term. The Interest Rate and annual percentage rate may increase after consummation. The Index for this product is the SOFR. The margin for this adjustable rate mortgage may vary with your unique credit history, and terms of your loan.

** Mortgage Rates are subject to change, loan amount and product restrictions and may not be available for your specific transaction at commitment or closing. Rates, and the margin for adjustable rate mortgages [if applicable], are subject to change without prior notice.

The rates and Annual Percentage Rate (APR) cited above may be only samples for the purpose of calculating payments and are based upon the following assumptions: minimum credit score of 740, 20% down payment (e.g. $20,000 down on a $100,000 purchase price), $1,950 in finance charges, and 30 days prepaid interest, 1 point, 30 day rate lock. The rates and APR will vary depending upon your unique credit history and the terms of your loan, e.g. the actual down payment percentages, points and fees for your transaction. Property taxes and homeowner's insurance are estimates and subject to change.