|

60 Delaware Street, City Not Found (Walton), CT, 13856 | $850,000

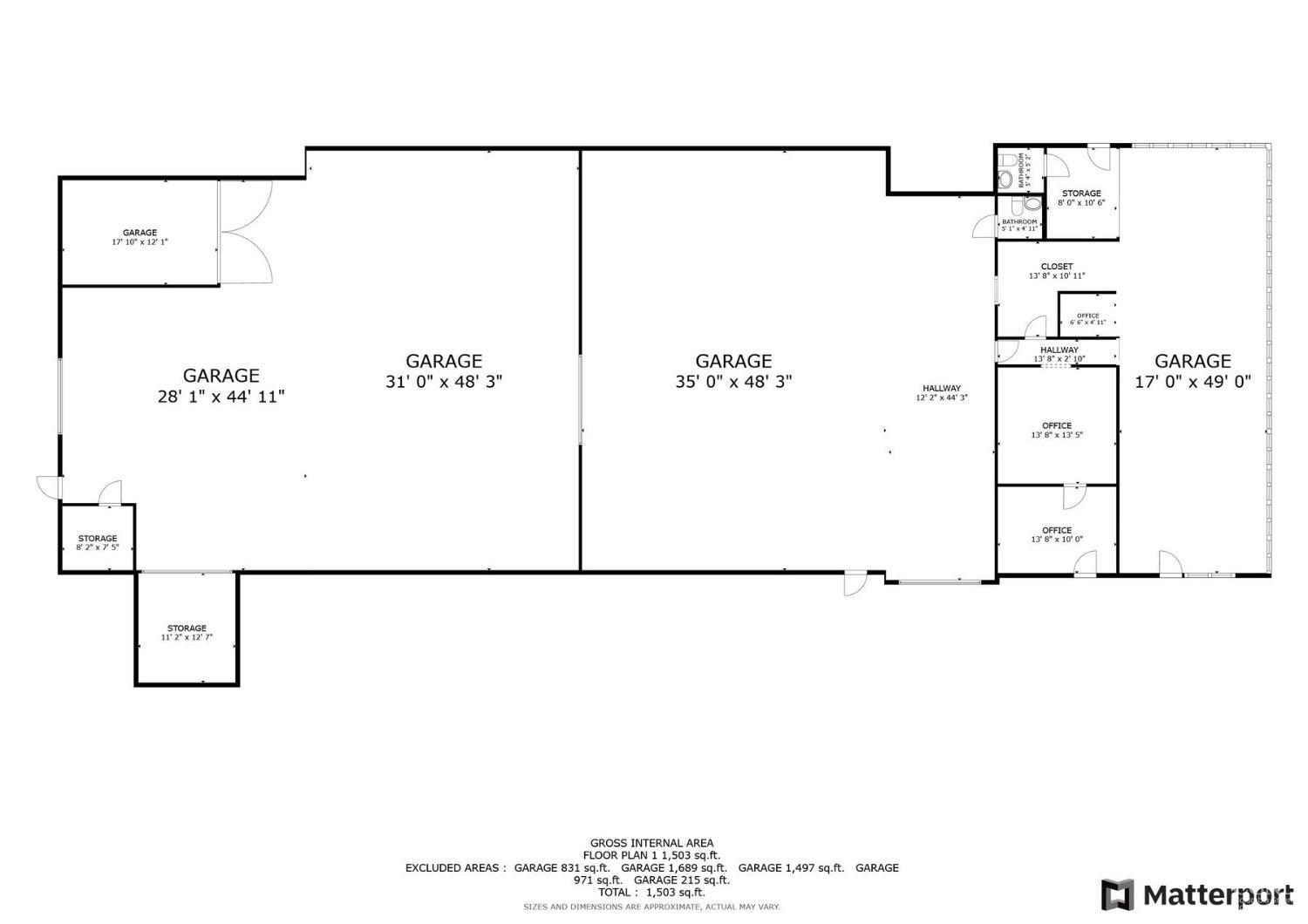

Nestled in the picturesque Catskill Mountain village of Walton, 60 Delaware Street represents a unique business opportunity. Located on a flat 2. 5-acre lot with approximately 110 feet of frontage on bustling State Route 10, this 7, 000 square foot building enjoys prime visibility with an average of 7, 677 vehicles passing daily. 60 Delaware's current incarnation is a successful auto repair and collision facility. The building features a large, combined showroom/office space with an open floor plan. The well-lit, state of the art shop area houses 16 bays with 4 lifts, and a spray booth and large frame machine will be included in the sale. A new roof was installed in 2022, 3-zone natural gas heating keeps utilities reasonable, and ample parking make this facility both modern and convenient - suited to a number of purposes. West Branch Collision and Classics isn't just a collision repair shop; it's a local powerhouse. Known for its thriving pre-owned Subaru dealership, it has captured the hearts of the community, achieving remarkable success over the past five years. The support from loyal customers has been overwhelming, fueling its growth and solidifying its place in the community. Adding to this success, a local towing company leases space on the property, creating a lucrative revenue stream and driving business straight to the shop's doors. Walton has a population of just over 5, 000 but is also a haven for outdoor enthusiasts, known for its Blue Ribbon trout fishing, wildlife (Bald Eagles soar past the display windows at 60 Delaware Street with frequency), and hunting opportunities. This offering is not just a chance to invest in a business opportunity but also to embrace the unique lifestyle that a small -own business in a resort area offers.

Features

- Town: City Not Found

- Parking: 40+

- Levels: 0

- Heating: Gas

- Approx Lot Sq. Feet: 108,900

- Lot Size: 2.5

- Year Built: 1973

- Approx Sq. Feet: 7,000

- Acreage: 2.5

- MLS#: 153853

- Days on Market: 102 days

- Website: https://www.raveis.com

/prop/153853/60delawarestreet_citynotfound_ct?source=qrflyer

William Raveis Family of Services

Our family of companies partner in delivering quality services in a one-stop-shopping environment. Together, we integrate the most comprehensive real estate, mortgage and insurance services available to fulfill your specific real estate needs.

Customer Service

888.699.8876

Contact@raveis.com

Our family of companies offer our clients a new level of full-service real estate. We shall:

- Market your home to realize a quick sale at the best possible price

- Place up to 20+ photos of your home on our website, raveis.com, which receives over 1 billion hits per year

- Provide frequent communication and tracking reports showing the Internet views your home received on raveis.com

- Showcase your home on raveis.com with a larger and more prominent format

- Give you the full resources and strength of William Raveis Real Estate, Mortgage & Insurance and our cutting-edge technology

To learn more about our credentials, visit raveis.com today.

Frank KolbSenior Vice President - Coaching & Strategic, William Raveis Mortgage, LLC

NMLS Mortgage Loan Originator ID 81725

203.980.8025

Frank.Kolb@raveis.com

Our Executive Mortgage Banker:

- Is available to meet with you in our office, your home or office, evenings or weekends

- Offers you pre-approval in minutes!

- Provides a guaranteed closing date that meets your needs

- Has access to hundreds of loan programs, all at competitive rates

- Is in constant contact with a full processing, underwriting, and closing staff to ensure an efficient transaction

Robert ReadeRegional SVP Insurance Sales, William Raveis Insurance

860.690.5052

Robert.Reade@raveis.com

Our Insurance Division:

- Will Provide a home insurance quote within 24 hours

- Offers full-service coverage such as Homeowner's, Auto, Life, Renter's, Flood and Valuable Items

- Partners with major insurance companies including Chubb, Kemper Unitrin, The Hartford, Progressive,

Encompass, Travelers, Fireman's Fund, Middleoak Mutual, One Beacon and American Reliable

Ray CashenPresident, William Raveis Attorney Network

203.925.4590

For homebuyers and sellers, our Attorney Network:

- Consult on purchase/sale and financing issues, reviews and prepares the sale agreement, fulfills lender

requirements, sets up escrows and title insurance, coordinates closing documents - Offers one-stop shopping; to satisfy closing, title, and insurance needs in a single consolidated experience

- Offers access to experienced closing attorneys at competitive rates

- Streamlines the process as a direct result of the established synergies among the William Raveis Family of Companies

60 Delaware Street, City Not Found (Walton), CT, 13856

$850,000

Customer Service

William Raveis Real Estate

Phone: 888.699.8876

Contact@raveis.com

Frank Kolb

Senior Vice President - Coaching & Strategic

William Raveis Mortgage, LLC

Phone: 203.980.8025

Frank.Kolb@raveis.com

NMLS Mortgage Loan Originator ID 81725

|

5/6 (30 Yr) Adjustable Rate Jumbo* |

30 Year Fixed-Rate Jumbo |

15 Year Fixed-Rate Jumbo |

|

|---|---|---|---|

| Loan Amount | $680,000 | $680,000 | $680,000 |

| Term | 360 months | 360 months | 180 months |

| Initial Interest Rate** | 5.375% | 6.125% | 5.625% |

| Interest Rate based on Index + Margin | 8.125% | ||

| Annual Percentage Rate | 6.769% | 6.270% | 5.864% |

| Monthly Tax Payment | N/A | N/A | N/A |

| H/O Insurance Payment | $92 | $92 | $92 |

| Initial Principal & Interest Pmt | $3,808 | $4,132 | $5,601 |

| Total Monthly Payment | $3,900 | $4,224 | $5,693 |

* The Initial Interest Rate and Initial Principal & Interest Payment are fixed for the first and adjust every six months thereafter for the remainder of the loan term. The Interest Rate and annual percentage rate may increase after consummation. The Index for this product is the SOFR. The margin for this adjustable rate mortgage may vary with your unique credit history, and terms of your loan.

** Mortgage Rates are subject to change, loan amount and product restrictions and may not be available for your specific transaction at commitment or closing. Rates, and the margin for adjustable rate mortgages [if applicable], are subject to change without prior notice.

The rates and Annual Percentage Rate (APR) cited above may be only samples for the purpose of calculating payments and are based upon the following assumptions: minimum credit score of 740, 20% down payment (e.g. $20,000 down on a $100,000 purchase price), $1,950 in finance charges, and 30 days prepaid interest, 1 point, 30 day rate lock. The rates and APR will vary depending upon your unique credit history and the terms of your loan, e.g. the actual down payment percentages, points and fees for your transaction. Property taxes and homeowner's insurance are estimates and subject to change.